rpzs.ru Learn

Learn

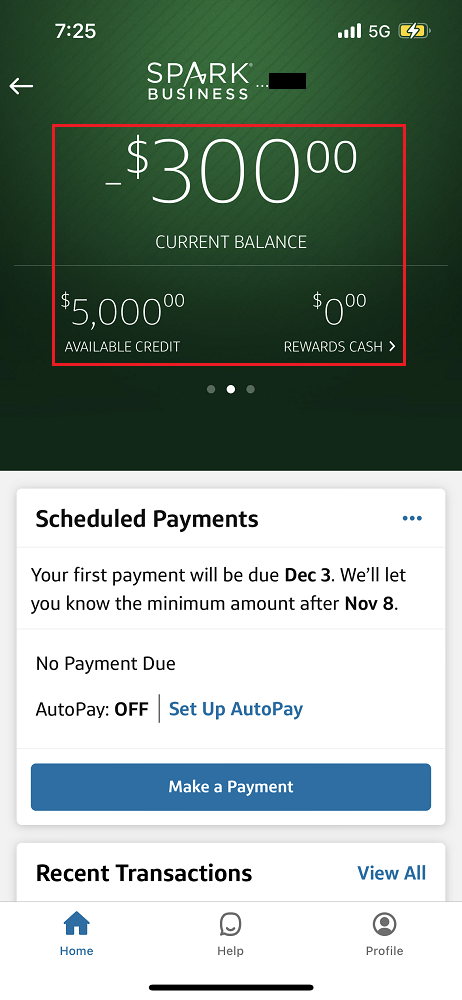

Capital One Spark Business Limit

Capital One Transforms the Small Business Credit Card Category with the launch of Spark Business · 2% cash back on every purchase, every day · One-time $ bonus. Unlimited % cash back; No annual fee; Free employee cards; Roadside assistance. Because this is a credit card you will have a credit limit, unlike a charge. Have Capital One Venture One card, Discover IT no annual fees and now Capital One Spark Business card $ limit. Use it all the time. More. Helpful The Capital One Spark Cash card lets you earn a flat 2% cash back across all of your purchases. There are no tiers or categories with this card. Earn unlimited 2% cash back for your business on every purchase, everywhere, no limits or category restrictions. $2, Welcome offer. Earn a $2, cash. The Capital One Spark Miles for Business card is a business travel credit card that earns 5 miles per dollar on hotels, vacation rentals and rental cars booked. most cards cap out at the k, but they should be offering you a matching credit line to use as a float account. With our business cards, you can earn unlimited rewards with no limits or expiration on all your purchases. To receive a statement credit up to $, you must use your Venture X Business or Spark Miles card to either complete the Global Entry application and pay the. Capital One Transforms the Small Business Credit Card Category with the launch of Spark Business · 2% cash back on every purchase, every day · One-time $ bonus. Unlimited % cash back; No annual fee; Free employee cards; Roadside assistance. Because this is a credit card you will have a credit limit, unlike a charge. Have Capital One Venture One card, Discover IT no annual fees and now Capital One Spark Business card $ limit. Use it all the time. More. Helpful The Capital One Spark Cash card lets you earn a flat 2% cash back across all of your purchases. There are no tiers or categories with this card. Earn unlimited 2% cash back for your business on every purchase, everywhere, no limits or category restrictions. $2, Welcome offer. Earn a $2, cash. The Capital One Spark Miles for Business card is a business travel credit card that earns 5 miles per dollar on hotels, vacation rentals and rental cars booked. most cards cap out at the k, but they should be offering you a matching credit line to use as a float account. With our business cards, you can earn unlimited rewards with no limits or expiration on all your purchases. To receive a statement credit up to $, you must use your Venture X Business or Spark Miles card to either complete the Global Entry application and pay the.

Capital One Spark Classic ($ minimum credit limit) · Capital One Spark Cash and Cash Select ($2, minimum credit limit) · Capital One Spark Miles and Miles. Recommended credit score: Limited, fair. Capital One Spark Classic for Business rewards. The Capital One Spark Classic for Business isn't a heavy hitter when it. The Capital One Spark Cash Plus Card is for the business owner who wants a top-cash back rewards rate with no spending cap, and without worrying about spending. Additional benefits · No preset spending limit. · Annual fee reimbursement. · Flexible due date. · Employee cards (physical and virtual). · Vendor payment. · Fraud. %. Unlimited Rewards. Earn unlimited % cash back for your business on every purchase, everywhere, no limits or category restrictions. · $ Cash Bonus. I have a brand new (small) business, and was approved (instantly) with a $12, Limit and it was raised to $15, after only 90 days. Easy to track and. The Capital One Spark Cash Plus is a charge card that offers a straightforward cash back rewards structure. Annual fee: $ APR: N/A (Pay-in-full charge card). The credit score needed to get approved for Capital One® Spark® Classic for Business is at least fair, which typically means a score of at least or higher. You get great purchase power as the card does not have a preset credit limit. Plus, every year your annual fee of $ will be refunded if you spend $, or. It offers unlimited 2X miles on every purchase. There are no caps or limitations. You also earn an extra 10X on hotels and rental cars. The card also lets you. The best things about the Spark Classic business card are its $0 annual fee and the 1% cash back that cardholders earn on all purchases. If you're applying for a credit line increase for your Spark business credit card, you'll also need to provide last year's total business revenue. Will a. One Spark Cash Plus is our top pick for the best Capital One business card. This charge card earns flat-rate cash back and has no preset spending limit. The Venture X Business offers unlimited 2x miles on every purchase; you can book through Capital One Travel to earn 5x miles on flights and 10x miles on hotels. This business credit card offers % cash back on all purchases, with no bonus categories or rewards caps, plus a welcome bonus and intro APR period. Capital One Spark Cash Plus is an excellent option for business operators whose expenses don't fall into the bonus categories on other business credit cards. $ if you spend $, or more in one year. None. PreviousNext. Alternatives to the Capital One Spark Cash Plus. Earn unlimited 2X miles on every purchase you make with the Spark Miles business credit card from Capital One. Apply online today. Best Capital One Business Card for Earning Cash-Back. Capital One Spark Cash Plus · · Earn a $2, cash bonus ; Best High-Limit Business Credit Card Bonus. Highlights · Join the business owners taking advantage of the Spark Cash card and its premium features! · Unlimited 2% cash back on every purchase—no rotating.

Disadvantages Of Heloc

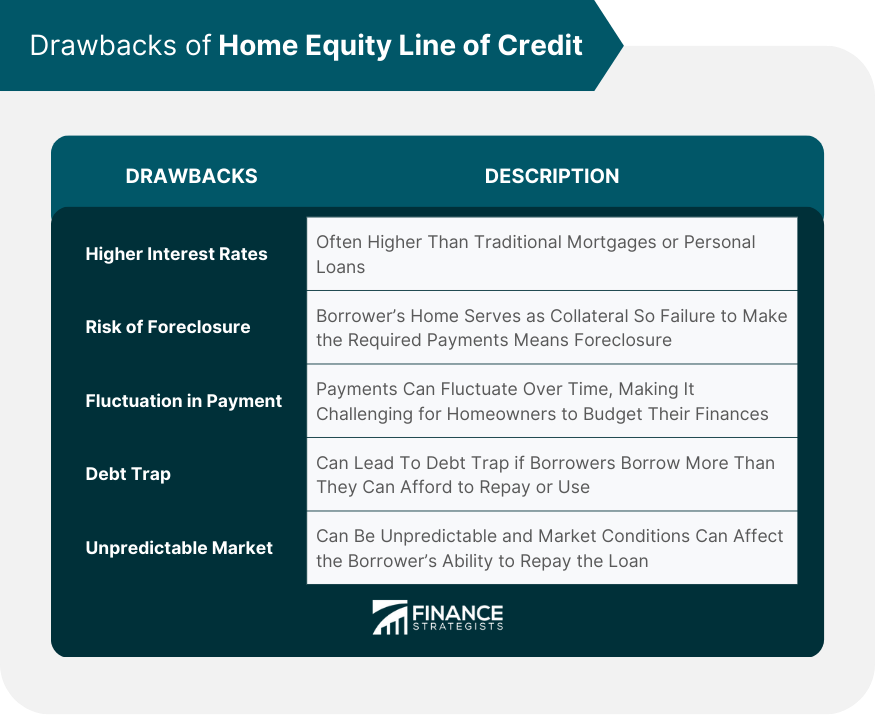

There are pros and cons to the flexibility that these loans offer. On the plus side, you can borrow against your credit line at any time, and you won't owe. A HELOC can be worthwhile to fund home improvements, but when used to pay for other things, it can result in bad debt. Considering taking out a home equity line of credit (HELOC)? Learn more about the pros and cons of a HELOC along with other alternative financing options. What are the pros and cons of taking out a mortgage vs. getting a HELOC on your house when buying investment property? There are pros and cons to the flexibility that these loans offer. On the plus side, you can borrow against your credit line at any time, and you won't owe. Variable Interest Rates: The primary drawback of a HELOC is the variable interest rate, which can result in fluctuating monthly payments. If interest rates rise. Disadvantages of a home equity line of credit. Tough credit requirements. You may need a higher minimum credit score to qualify than you would for a standard. HELOCs and home equity loans act as second mortgages, using your property as collateral for the debt. So, defaulting on the monthly loan payments means the. Advantages and disadvantages of home equity loans · Home equity loans may offer lower interest rates and access to larger funds. · There may be tax perks. · Home. There are pros and cons to the flexibility that these loans offer. On the plus side, you can borrow against your credit line at any time, and you won't owe. A HELOC can be worthwhile to fund home improvements, but when used to pay for other things, it can result in bad debt. Considering taking out a home equity line of credit (HELOC)? Learn more about the pros and cons of a HELOC along with other alternative financing options. What are the pros and cons of taking out a mortgage vs. getting a HELOC on your house when buying investment property? There are pros and cons to the flexibility that these loans offer. On the plus side, you can borrow against your credit line at any time, and you won't owe. Variable Interest Rates: The primary drawback of a HELOC is the variable interest rate, which can result in fluctuating monthly payments. If interest rates rise. Disadvantages of a home equity line of credit. Tough credit requirements. You may need a higher minimum credit score to qualify than you would for a standard. HELOCs and home equity loans act as second mortgages, using your property as collateral for the debt. So, defaulting on the monthly loan payments means the. Advantages and disadvantages of home equity loans · Home equity loans may offer lower interest rates and access to larger funds. · There may be tax perks. · Home.

The drawback of a HELOC is that the interest rate is variable. This means that if rates rise, your payment will go up. This makes it harder to budget for. Disadvantages include: · A HELOC is open for a limited time (at WaFd, there is a year draw period and year repayment period); after that's up, you'll need. Having a HELOC could increase your debt-to-income ratio, making it more difficult to be approved for other loans or credit. Set Withdrawal Period: All HELOCs. Cons Of HELOC Loans. On the opposite end, the cons of a HELOC lie in the risk profile of a home equity line of credit. Your Home Is Collateral. A HELOC can be worthwhile to fund home improvements, but when used to Learn how they compare and the pros and cons of each home loan option. more. My question is, what drawbacks are there to a HELOC? If we take the HELOC and don't use the money, and just let it sit there until we absolutely have to use. Disadvantages of A Home Equity Line of Credit · Loan collateral: Perhaps the biggest disadvantage, or risk, of a HELOC is that your house is secured as. HELOC rates are generally significantly lower than the interest rates for credit cards or personal loans but slightly higher than the rates on a. The obvious disadvantage is that HELOCs require the ownership of real estate, which means defaulting on the loan could cost you your home. Also, since the. The disadvantages of a HELOC is that the rate is variable during the draw period and can change if the Prime Rate (as stated in the Wall Street Journal) changes. Disadvantages of a HELOC: 1. Variable interest rate HELOCs usually have variable interest rate that fluctuate over time, meaning your monthly payments increase. The flexibility of a HELOC might lead to borrowing more than necessary, potentially resulting in debt accumulation. It can be tempting to borrow more than you. a HELOC loan. Advantages and Disadvantages of HELOCs. Like we just stated, HELOCs have great advantages but they also have some drawbacks you should be aware of. Though they offer plenty of perks, HELOCs naturally come with some disadvantages which can be avoided by managing your usage. Variable rates can lead to higher. Speaking about the drawbacks, a HELOC typically comes with a variable interest rate. This means that your APR can change under certain economic conditions. If. Bear in mind that interest rates on most HELOCs are variable. The big advantage to a credit line is that you can borrow whatever amount you need as you need. Additionally, many HELOCs have adjustable interest rates, which means they go up or down according to standard rates. This can be both a pro and a con. It is only subsequently during the repayment period that you repay the loan itself in addition. HELOC interest rates also tend to be variable, rather than fixed. DISADVANTAGES. RETIREMENT PLAN. LOAN. You borrow from your retirement savings costs for a HELOC. Others may charge fees. For example, you might get. What Is a HELOC? HELOCs work in many ways, much like credit cards. The lender gives you a line of credit, based on the value of your home equity.

Open Bank Account And Get Paid

Deposit checks with mobile deposit · Add cards to your digital wallet · Send and receive money with Zelle · Get help with Fargo® virtual assistant · View your. It's always great to get something for nothing, especially when it comes to your bank account. That way, more of your hard earned money stays right where it. Get $ with our checking account bonus offer. Earn $ when opening an eligible Fifth Third checking account with qualifying activities. Open your online checking account in minutes and get access to over 55, no‑fee ATMs and zero account fees. Plus, get your paycheck up to two days early. Do you want a bank account you can open and operate entirely online? Or are you more keen on being able to head into a branch to sort things out? If the latter. Simplify your finances and stay on top of cashflow with Open. Connect bank accounts to pay vendors, receive payments, and reconcile effortlessly. images. Get. Open an Everyday Checking account** with a minimum opening deposit of $25 from this offer webpage. Complete the qualifying requirements to receive your $ Open a U.S. Bank Smartly Checking account by September 26, Within 90 days of account opening, enroll in online banking or get the U.S. Bank app. Make. Apply for a checking account online today and earn $ with Associated Bank's current checking account bonus offer. Deposit checks with mobile deposit · Add cards to your digital wallet · Send and receive money with Zelle · Get help with Fargo® virtual assistant · View your. It's always great to get something for nothing, especially when it comes to your bank account. That way, more of your hard earned money stays right where it. Get $ with our checking account bonus offer. Earn $ when opening an eligible Fifth Third checking account with qualifying activities. Open your online checking account in minutes and get access to over 55, no‑fee ATMs and zero account fees. Plus, get your paycheck up to two days early. Do you want a bank account you can open and operate entirely online? Or are you more keen on being able to head into a branch to sort things out? If the latter. Simplify your finances and stay on top of cashflow with Open. Connect bank accounts to pay vendors, receive payments, and reconcile effortlessly. images. Get. Open an Everyday Checking account** with a minimum opening deposit of $25 from this offer webpage. Complete the qualifying requirements to receive your $ Open a U.S. Bank Smartly Checking account by September 26, Within 90 days of account opening, enroll in online banking or get the U.S. Bank app. Make. Apply for a checking account online today and earn $ with Associated Bank's current checking account bonus offer.

When you open a bank account with Capital One it means no waiting in line for account access, plus great rates and zero fees - all in one place. Get paid up to 2 days early when you have direct deposit. No need to sign up and it's absolutely free. This new feature gives you earlier access to your cash. For a limited time, you can receive $, $, $ or $ by opening new deposit accounts and meeting all deposit and minimum balance requirements for Make a deposit to start banking. Transfer money into your new account. Then, register for digital banking to get started. Some banks will pay you hundreds of dollars as a cash bonus to open a checking or savings account. These are the banks offering some of the largest bonuses. Settle up or get paid. Here's what our customers have to say about us. We believe there is only so much you can learn from a website. Get in touch · Open an. !* Open a No-Fee Bank Account between July 1st and December 31st, and you could win a $1, giveaway!* Already a member? Refer a friend to be entered to win. Why you'll love it: You get an interest-earning checking account with access to financial tools and benefits to help you manage your money. Get overdraft. Best Banks That Pay You To Open an Account · Simplii Financial: $ bonus. · Scotiabank: $ bonus. · BMO: Up to $ bonus. · Neo Financial: Up to $25 bonus. There is no minimum amount of money required to open a bank account. However, a small initial deposit can help pay for and monthly maintenance fees. Open your online checking account in minutes and get access to over 55, no‑fee ATMs and zero account fees. Plus, get your paycheck up to two days early. Earn a cash bonus in three steps: · Open a new eligible business checking account by December 31, · Deposit $5, or more in New Money* directly into your. Choose the account that's right for you. With features like Citizens Paid Early™ which lets you get paid sooner—up to 2 days early You may also be able to get local bank details for a range of foreign currencies, which you can give to others to have them send you money conveniently. That. Access your money up to 2 days sooner than payday with early paycheck. Get help in person. Visit our branches &. Make the most of every dollar with an online bank account that helps you avoid fees, get paid early, and reach your money goals faster with Varo Bank. 2 If you open a checking account at a credit union, your money will get the same kind of protection from the National Credit Union Association Checking. Open up to 10 accounts. Learn More. Neo High-Interest Savings account. Manage Real-time notificationsGet instantly notified when money goes in or out. No minimum deposit to get started and get your money up to two business days sooner with early direct deposit. start saving your money. Checking. Find. Canada's banks offer a variety of bank accounts to help consumers manage their money. You can find this information in your current passbook or account.